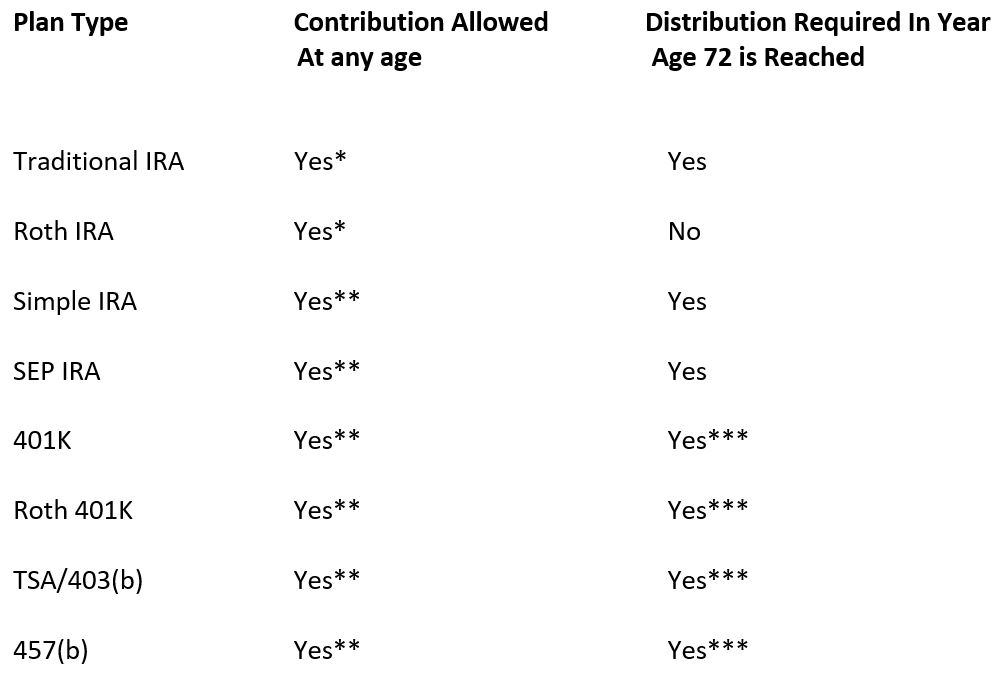

Many people are confused about whether they can contribute to their plan or when they have to start plan distributions once they reach age 72. Listed below are the common retirement plans in use by most people today and a summary of the respective plan contribution and distribution rules.

*–must have compensation as defined by the IRS, see IRS Publication 590-A.

**–must be actively employed by the plan sponsor and subject to their rules, see IRS Publications 560 and 571.

***–must start receiving distributions by April 1 following the year you retire or attainment of age 72, whichever is later. Special case rules could allow deferrals until age 75 on TSA/403 (b) for plans before 1987.

For more detailed information on contribution and distribution amounts, speak to your financial advisor and/or tax professional. Information is also available through a search on www.IRS.gov.

If you do not take a distribution that is required, the IRS may impose a 50% excise tax on the difference between the required minimum distribution and the amount actually distributed. A waiver can be requested using IRS Form 5329 along with a letter of explanation.

This was written by George S. Urist, MBA, CFP®, President and Owner of Urist Financial and Retirement Planning, Inc., located in East Syracuse, New York. George has been a CERTIFIED FINANCIAL PLANNER™ practitioner and Registered Representative with LPL Financial for over 34 years. George can be followed on twitter @gurist and reached at 315-445-2147 or george.urist@lpl.com. Company information can be found at www.uristfinancial.com. Securities offered through LPL Financial. Member FINRA/SIPC